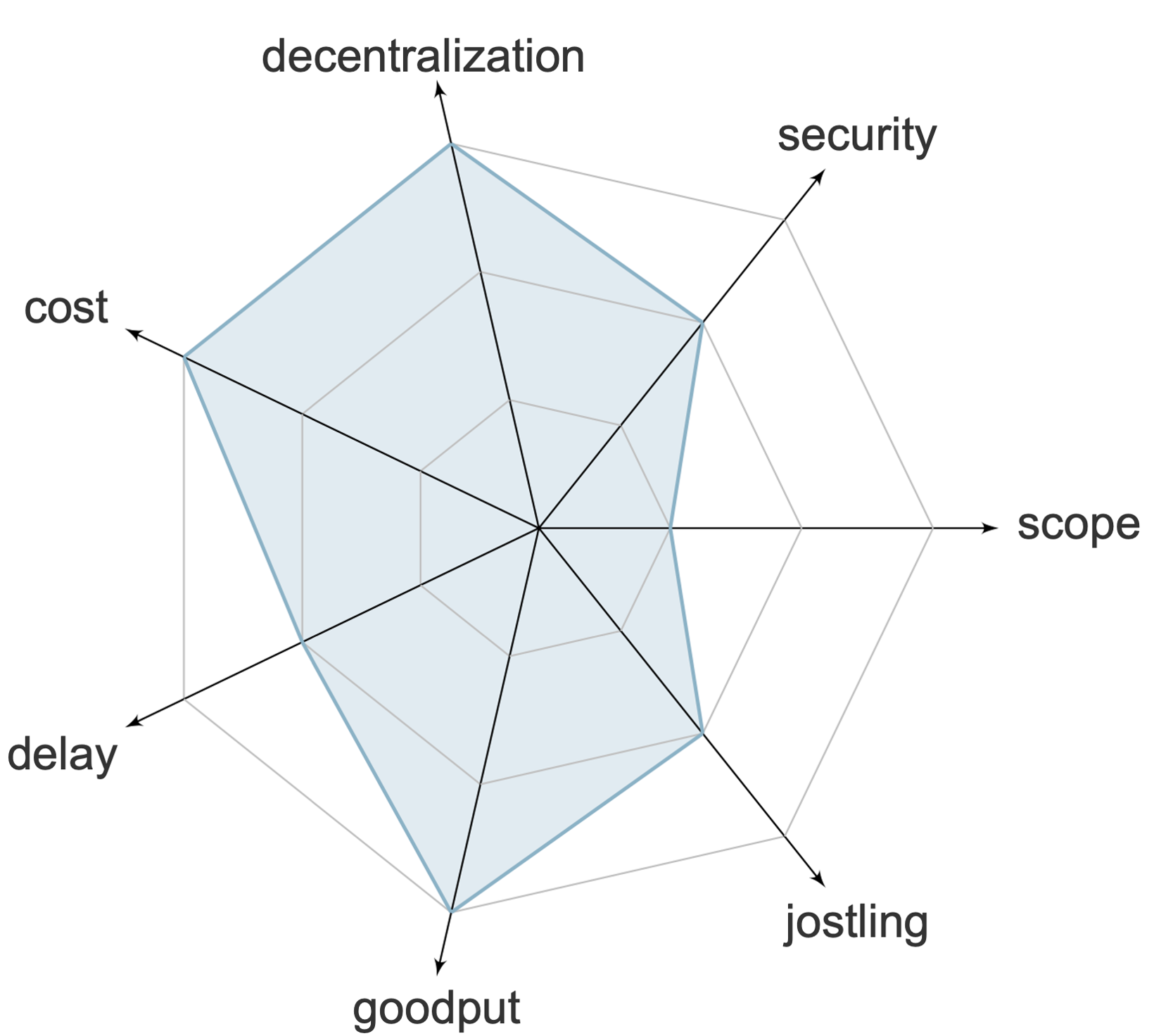

Positives

- No impact on decentralization

- No increase in transaction cost

- Unchanged blockchain's goodput

- Unchanged blockchain's transaction ordering

Negatives

- Scope limited to specific applications

- Slight transaction delay increase

- Increased competition among similar transactions